BBC News

BBC NewsBorrowing was £17.4bn last month, the second highest October figure since monthly records began in 1993.

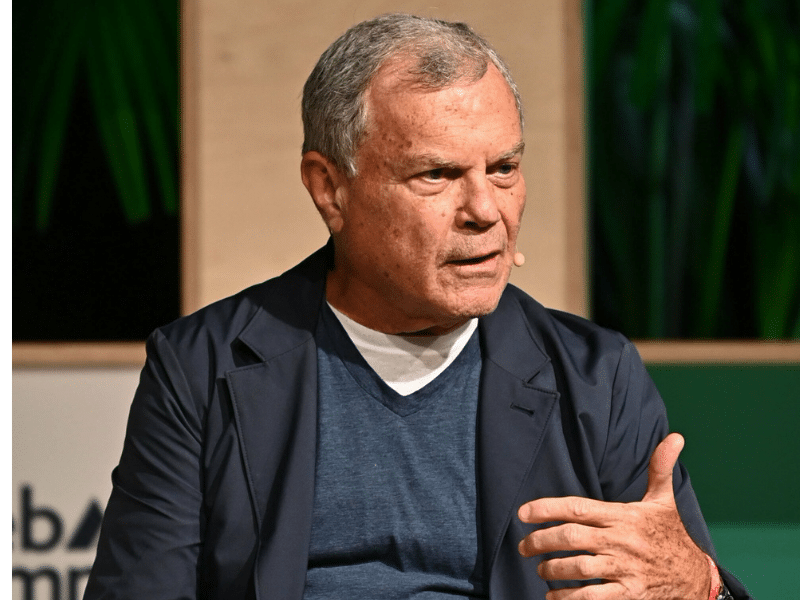

Sir Martin Sorrell

Of course, it has been a terrible time. The 2020-2022 pandemic has been a disaster for so many people, especially the disadvantaged – and it’s been disastrous across all nations. Having said that, people don’t always realise the sheer scale of the digital transformation which took place alongside it.

Consumers are buying healthcare online, and High Street retailers are struggling here in London. Habits have shifted dramatically: in the media, the streamers continue to gain market share, and free-to- air networks are under pressure, as are newspapers and traditional media enterprises.

In this context, inflation ought not to come as no surprise. Clients will look for price increases to cover commodity increases. The big question is whether inflation is endemic or transient. We clearly have shortages of labour supply, as well as supply chain disruption, and that means that companies will be looking to cover those problems with price increase. That means inflation will be well above trend throughout 2022 and 2023.

The priority in central bank policy to date has been on employment, and now there is more friction in the labour market. Employees have more power now: the pandemic has encouraged people to think about what they want to do and how they want to do it. That’s made inflation in wages significant. I expect wage inflation to continue throughout the year but that in turn means that employers will look at their cost structures.

Crucially, it will also bring automation into the picture. If labour is in short supply and increasingly expensive, that will accelerate the technological changes around AI (artificial intelligence) and AR (augmented reality). The metaverse has been thoroughly hyped but listening to Bill Gates and others, it clearly will have a major impact.

As we look ahead, I think people who underestimated Donald Trump are going to be surprised – and I also wouldn’t personally underestimate Ivanka. Trump’s moves on the media side with Truth Social are interesting.

We are still talking to one another in our echo chambers. I spoke to a Chief Executive of a leading package company recently; he had just been holidaying in Alabama, Kentucky and Mississippi on a motorbike; there were Trump fans everywhere. Lionel Barber, the editor of the Financial Times, tells the story of the Tuesday before Brexit. He went to see Cameron and right up until the last minute Cameron’s polls told him he would win; Barber told him he was wrong. It is the same with Trump now; everybody underestimates his pull with voters.

Lately I have been reading Ray Dalio’s book: The Changing World Order: Why Nations Succeed and Fail, and that’s an interesting read which I highly recommend. It contains some fascinating graphs on the rise of inequality; the book explains how there are forces at work there whose power we have a tendency to underestimate. It’s a book which makes you realise the importance of China, where his intellectual focus is.

But I don’t see much reason to despair. Companies were better run during Covid; it meant that the entre was unable to interfere, and individual employees were given greater responsibility. By the end of 2022, we’ve begun to see some of the downsides, having been initially very positive about it. I’d say a digital fatigue began to set in towards the end of 2021, and so we’ve had to manage that.

Sometimes, I think back on what we’ve lived through over the past few years. I think in retrospect Kate Bingham was the hero of that hour, and I see she has just realised her memoir The Long Shot: The Inside Story of the Race to Vaccinate Britain. What she achieved with her procurement team ought to be a continuing source of inspiration. She was more focused on getting the product than the cost. That was crucial – that she realised she wasn’t buying sugar or commodities – but something essential. There are lessons there for business: you have to devote your energies to the essential.

The writer is the founder and CEO of S4 Capital